Victoria

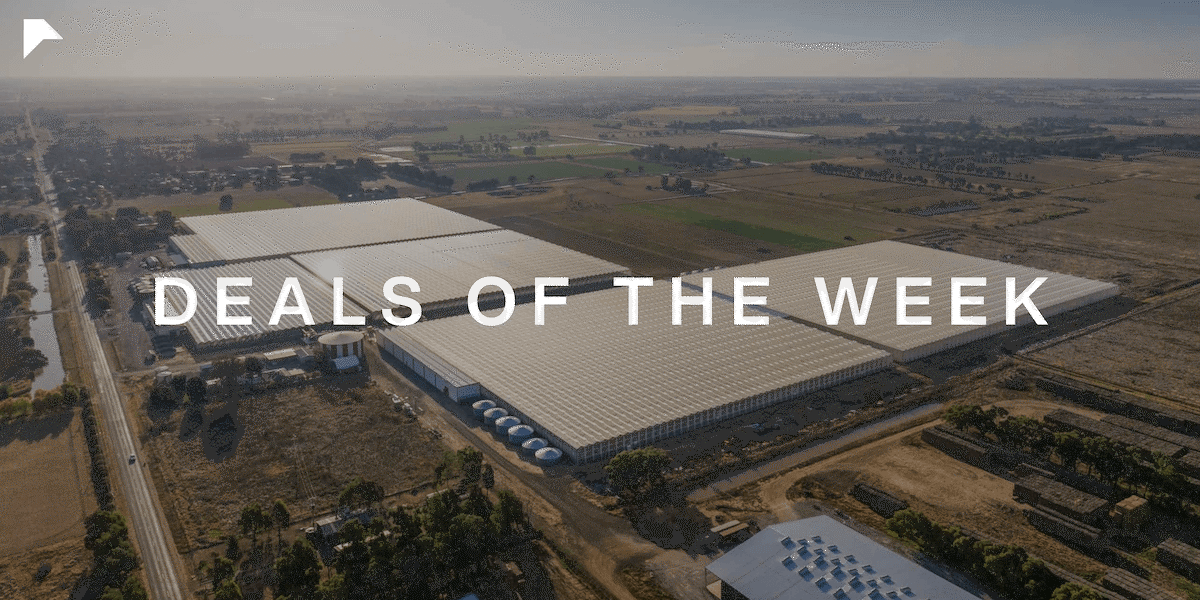

KATUNGA - Speculated Circa $100 million

Centuria Capital has expanded its agriculture portfolio with the purchase of Katunga Fresh's 21-hectare glasshouse facility in Northern Victoria, taking Centuria's total agriculture assets under management to $650 million.

The asset will be owned by the unlisted, open-ended Centuria Agriculture Fund, which now has five large-scale tomato glasshouse infrastructure facilities, totalling a value of circa $450 million and 100% occupancy.

The off-market sale-and-leaseback transaction was secured on a 20-year triple-net lease. Operator Katunga Fresh is one of Australia’s largest suppliers of tomatoes and it has operated from this site for 20 years.

MORDIALLOC - $13 million

ASX-listed Abacus Storage King has purchased an 11,760 sqm industrial site in Melbourne's South East.

The property was formerly the home of Mr Donut, who had occupied the site since 2004, which holds a 5,268 sqm warehouse that includes cold storage and food processing facilities along with office amenities.

The deal was managed by Stonebridge's Rorey James, Dylan Kilner and Chao Zhang, in conjunction with Link Property Business Brokers' Steven Mostafa and Nadia Polzella and represents the largest transaction within the Southeast industrial sector for 2024.

ST KILDA - Circa $6 million

A local private investor has purchased St Kilda’s Tolarno Hotel for circa $6 million after 30 years of ownership by James Fagan and Bernard Corser.

Located at 42 Fitzroy Street, the 37-room hotel sits on a 968 sqm site and comprises a restaurant and bar, operated by the likes of Chefs Iain Hewitson and Guy Grossi, as well as a function room. The hotel sale was subject to an existing lease to a recognised hotel owner.

CBRE’s Scott Callow and Nathan Mufale brokered the deal on behalf of the vendors.

Queensland

NUNDAH - $51.25 million

Institutional fund RAM has purchased a brand new healthcare facility at 20 Nellie Street in a deal managed by RWC Medical's Franz Stapelberg, Chris Meyer, Nicolas Milner and Jesse Meyer.

Purchased by RAM's Healthcare Opportunity Strategy, the asset comprises four buildings with 10,000 sqm of NLA which is occupied by a diverse range of healthcare operators, including Lumus Radiology, Lvy Dental and Lvy Medical.

RIPLEY - $7.6 million

Fund Manager Clarence Property has sold a brand-new Ripley childcare centre to a private Brisbane-based investor for $7.6 million, as the asset class continues to be highly sought after.

Located at 1 Brooking Rise, the 977 sqm childcare centre opened in May last year and sits on a 3,378 sqm allotment.

The 154-place centre is secured by a 15-year net lease to Little Locals Early Learning Group, a privately owned business with eight childcare centres throughout the Southeast Queensland regions.

CBRE’s Harrison Coburn brokered the deal off-market, achieving a 5.4% yield on behalf of Clarence Property.

SPRINGWOOD - $4 million

A 3-storey commercial property in Springwood has been transacted on behalf of Invest Logan to a not-for-profit organisation that educates, supports and empowers women and their families across the Redlands and Logan region, The Centre for Women & Co.

The 805 sqm freehold centre zoned property located at 8 Cinderella Drive in Springwood was transacted by Colliers' Philip O’Dwyer.

New South Wales

RICHMOND - $35 million

Richmond Mall, the first Sydney metropolitan neighbourhood centre offered to the market in 2024, has been sold to a private investor.

The recently refurbished neighbourhood centre is anchored by a strong performing Coles supermarket, historically paying percentage rent, and is supported by a diverse mix of 11 convenience specialty retailers. The transaction represents a benchmark fully leased yield of 5.73%.

Colliers' James Wilson and Ben Wilkinson, in conjunction with JLL's Sam Hatcher, Nick Willis, Sebastian Fahey and David Mahood sold the property at 271 Windsor Street, on behalf of Fund Manager IP Generation.

FOREST LODGE - $2.225 million

An owner-occupier has purchased a circa 600 sqm mixed-use development site from a private investor at 1 Kimber Lane.

The asset is a versatile land improved with a single-storey dwelling within an exclusive pocket of Forest Lodge, a strategic inner-city location nestled between Glebe, Annandale and Newtown.

The deal was negotiated by Colliers' James Cowan and Michael Crombie.

Western Australia

KINGSLEY - $5.2 million

A local investor has purchased a brand-new Western Australian childcare centre, making it one of the first modern childcare centre transactions in nearly 12 months for the region, which has seen a lack of quality childcare transaction outcomes since 2023.

Located at 73 Kingsley Drive, Kingsley, the 650 sqm centre is fully leased to ASX-listed Nido Early Learning, under a 20-year initial lease agreement.

CBRE’s Sandro Peluso, Jimmy Tat, Marcello Caspani-Muto, Chloe Mason and Derek Barlow managed the sale which achieved a yield of 6.0%.