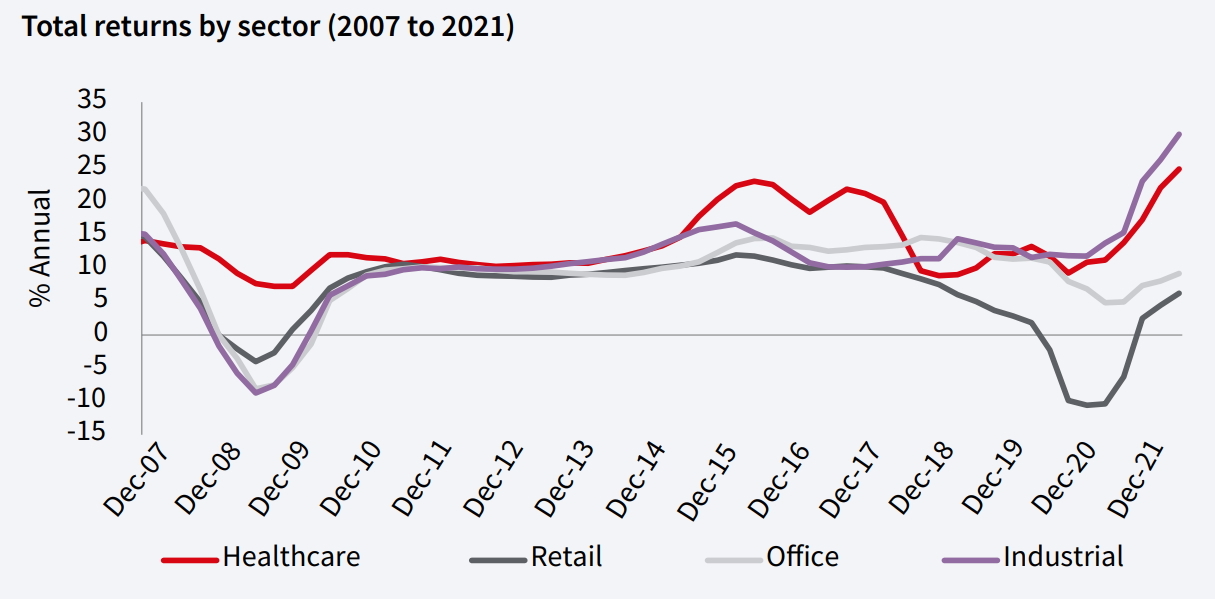

“Healthcare returns have exceeded average annual office and retail total returns on both a five-year and 10-year basis.”

In uncertain times, a secure investment is held in high esteem. As the cash rate continues to propel upwards in an effort to combat inflation, the commercial property market has come to appreciate the inherent value offered by the healthcare sector.

An Expressions of Interest campaign for the Roy Fagan Centre in Lenah Valley, Tasmania, has brought our attention back to the healthcare field, and seems set to illustrate the prized nature of this asset class. The agent behind the listing, Phillip Apelbaum of Healthcare Property Group, has described the 42-bed psychiatric facility as a “rare and affordable hospital investment opportunity”. Leased out by the Tasmanian Government, the 2,612 sqm building is a high-quality asset that is likely to attract significant interest.

Roy Fagan Centre - 54 Kalang Ave, Lenah Valley TAS 7008

This assessment of the property is echoed by industry experts across the country. In June of this year, JLL published their Exploring Australian Healthcare Opportunities report, which focuses on the real estate outlook for Australian healthcare. In that report, JLL predicts that “the healthcare sector may see more moderate negative impacts on pricing with investors favouring assets underwritten by essential services and stable income profiles.”

This is an extension of the healthcare real estate sector’s strong fundamentals in returns, which relative to the size of the sector itself, have delivered investors major profits.

“Healthcare returns have exceeded average annual office and retail total returns on both a five-year and 10-year basis.”

This fact has led to the industry reporting lower yields than ever before; at 4.8%, average healthcare yields have dipped to historical depths, and now sit between the industrial and office sectors. “The growing number of active acquirers and strong capital appetite across the healthcare sector has contributed to competitive pricing in recent years.”

Total returns by sector (2007 to 2021) - Courtesy of JLL

The in-demand nature of these assets has resulted in agencies dedicating more resources than ever to the healthcare sector. CBRE held their maiden Healthcare & Childcare Portfolio Auction on August 24th, and secured notable sales for a radiology clinic and a medical centre, prompting $4 million of capital to change hands. According to CBRE’s Derek Barlow, “medical-related assets have emerged from the COVID-19 pandemic offering recession resistant lease covenants and a solid government funding support base.”

According to their Healthcare Opportunities document, JLL estimate that “Australia’s healthcare real estate sector is currently valued at around AUD $40 billion, equating to around 25% of the industrial sector and just 10% of the office sector by value.” This sector is still distinctly smaller in scale when compared to the other prominent asset classes, and that has created serious investor. With competition so high, properties like the Roy Fagan Centre seem destined to only rise in value.

View the listing for the Roy Fagan Centre on CommercialReady here.