JLL’s Hotel Investment Highlights – Asia Pacific report for the second half of 2022 was released this past week, and it demonstrates just how significant an asset class hotels remain; not just in Australia, but across the entire region. Asia Pacific hotel transaction volume is expected to exceed US$10.7 billion in 2022, representing a 14% increase year-on-year. If certain deals transact, JLL predicts that full-year volumes could reach US$1.4 billion.

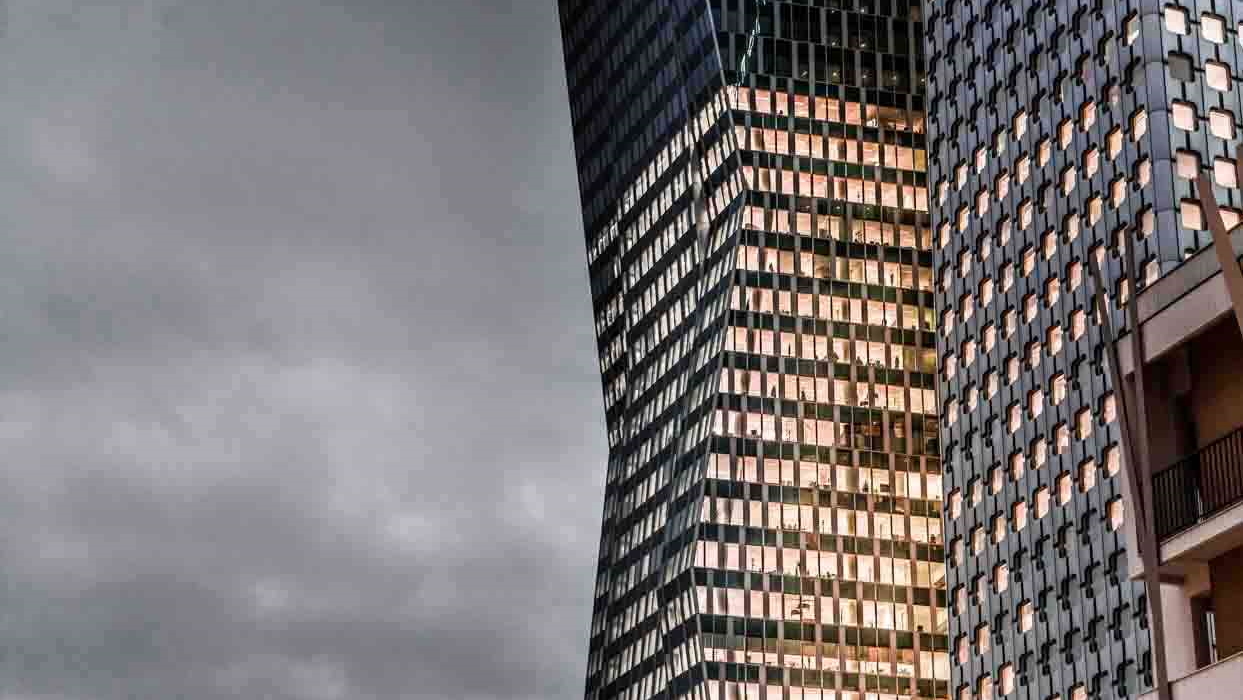

The biggest contributors to these figures have been the headline sales. Back in May, one of the country’s preeminent hospitality offerings, The Hilton Sydney, was sold to the Hong Kong-based investment manager Baring Private Equity Asia, in what amounted to Australia’s biggest single hotel deal.

The Hilton Sydney - Its recent purchase equated to Australia's biggest single hotel deal

Back in August, we deconstructed CBRE’s In and Out Australia report, and identified a notable statistic; in terms of year-on-year change, Hong Kong expenditure into Australian commercial property during the first half of 2022 increased by an eyebrow-raising AU$641 million. The Hilton Sydney’s sale seems to be directly responsible for much of this increase.

Much of the interest in the sector is being driven by the refurbishment of established hotels. “Repositioning [and] redevelopment of older assets, particularly in Melbourne and Sydney, [has become] a recurring theme,” according to the report. “Recent transactions include Hotel Lindrum and the Sir Stamford Circular Quay, with both hotels being acquired for their value-add potential and set to be redeveloped into alternative uses.”

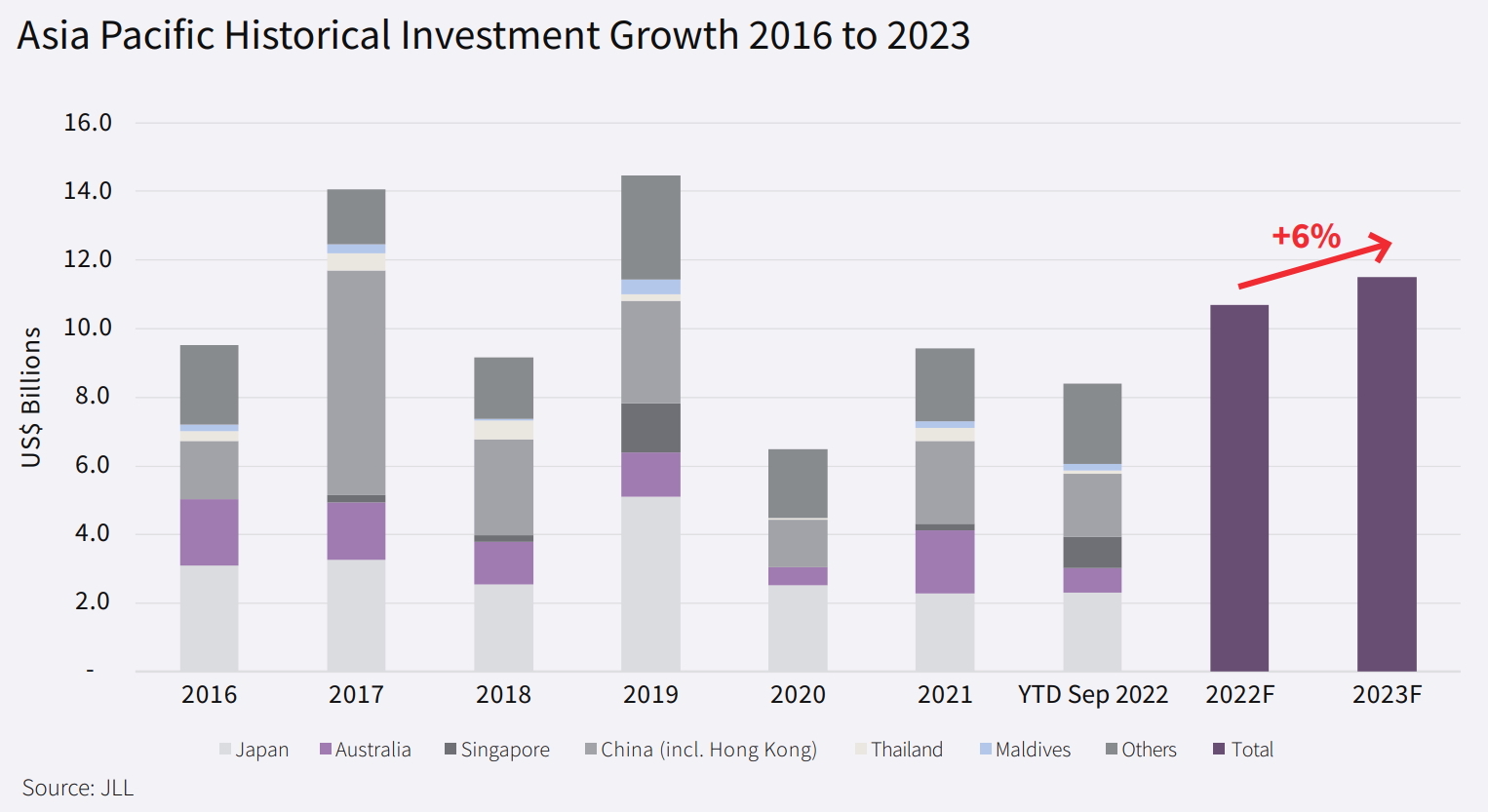

Asia Pacific historical investment growth - Courtesy of JLL

But given the inflationary pressures being exerted over the real estate sector, how are investors funding these purchases and projects? According to JLL’s report, most buyers across the Asia Pacific region are finding that their capital resources have either stagnated or weakened.

“With rising interest rates, all roads now lead to debt. JLL’s most recent survey of investors reported an overwhelming majority of 74 per cent indicating that their access to debt had remained similar to 2021 levels or deteriorated further, and 63 per cent indicating that borrowing costs had increased.”

Despite this, JLL’s investment volume across the region is positive; transaction volume for the current year is expected to exceed US$10.7 billion before climbing even higher in 2023, to US$11.5 billion. With that, it’s anticipated that Australia will hold firm, producing a slightly increased volume of US$1.5 billion in the coming year.

That might seem odd, given how much of this year's transacted capital was contributed via a single deal; The Hilton Sydney's sale. But according to JLL's Peter Harper, their methodology when forecasting yearly volume takes into account large-scale deals.

"Looking back at the past 10 years, on average the largest 10 deals in any one year typically account for around 70% of total transaction volume. Whilst the record-breaking Hilton Sydney sale accounted for $530 million this year, we generally see a couple of large-scale deals per annum. Moving into 2023, we are aware of several big-ticket deals that will likely take place and lay the foundations for another strong year of transaction volumes."

Given the level of hotel-related interest being exhibited by both intranational and international investors, JLL are confident that 2023 will have its own collection of major sales.

Graphic courtesy of JLL

Ready Capital’s Amir Bani has identified a similar trajectory. “Ready Capital has seen an uptick in both investors and developers enquiring about our services, specifically dealing with lenders appetite for hotel assets both international and national chains,” Mr. Bani explained.

“Despite the macro and geopolitical challenges that influence capital activity, I think the sector’s performance will continue to remain strong given strong demand from domestic tourism and the resurgence in overseas tourism. Keep in mind: Australia has a reputation as a safe and friendly environment, which is perfect for hospitality investors.”

As tourism continues its recovery in the wake of COVID-19, JLL's mostly positive outlook on the industry envisions further growth as hotels continue to serve as a resilient, popular form of commercial property.