This week, the Reserve Bank of Australia (RBA) increased the cash rate to 0.85%, soon after hiking the rate in May. With construction costs and fuel prices feeding inflation, experts have forecasted that the cash rate could potentially hit 2.5% by mid-2023. Given that this latest rise was the biggest single increase in 22 years, those predictions don’t seem particularly outlandish.

Despite this, the commercial property market hasn’t lost its hankering for quality assets. In fact, some are arguing that inflation is a motivator for investing.

“The market continues to be driven by significant amounts of uninvested equity rather than concerns about borrowing costs.”

This was the message from the Managing Director of Emmetts Real Estate, Charles Emmett, who successfully brokered a sale of a banking outlet in the heart of Werribee last Friday afternoon, alongside fellow agents Andrew Milligan and Geoff Emmett. Starting bidding at $5.5 million, Emmetts was able to secure a $7.01 million sale, representing an initial yield of 3.5%.

A big reason this sale was so successful came down to the location. Melbourne’s west is the fastest growing region in Australia, and the Victorian State Government in conjunction with Wyndham City are committed to developing Werribee into West Melbourne’s capital.

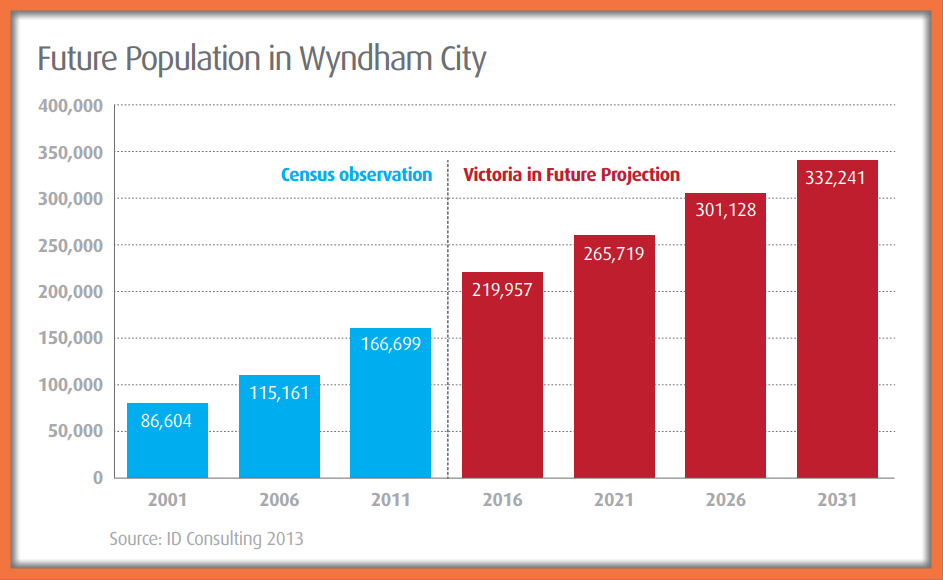

Population growth projections are extremely favourable for all of Wyndham, but specifically Werribee, and with the suburb’s centre containing a wide range of facilities and amenities, including specialist retail, public transport, high-density residential, government agencies and local convenience retail, it is no surprise that the state government have identified the Activity Centre of Werribee as a National Employment and Innovation Cluster, as part of their Plan Melbourne 2017-2050 Strategy document.

Future population in Wyndham City

More specifically, this sale was for a property on Watton Street, which has a front-row seat to the main community retail and commercial hub in Werribee. This shopping strip has a strong local following, and attracts high levels of pedestrian footfall, whilst consistently maintaining a low vacancy rate.

“Due to its geographic situation, the strip benefits from a lack of competition from other nearby retail strips, which has led to minimal vacancy,” stated Mr. Emmett. “There is probably one vacancy along the entire 1-kilometre strip.”

In an article earlier this week, we took a deep dive into the world of Melbourne’s shopping strips, and found that based on the published surveys and analysis, there is a correlation between vacancy rate and rental range per sqm. The most obvious example is Church Street in Brighton, which consistently has a sub-2.5% vacancy rate, bottoming out at 0.71% in 2021. The area has a rental range per sqm of $1,250-$1,350, which eclipses its contemporary strips.

That low vacancy rate is what drives the consistently impressive yields secured in sales for properties on the street. Just last year, 13 Church Street sold for $6.07 million, for an extremely sharp yield of 2.5%. The same principle is applied to Watton Street. With a history of low vacancy, rental income for owners is strong, and the security in tenancies is high.

But the tenant in question wasn’t just any standard business; 22 Watton Street is home to a two-storey NAB outlet that deals in both retail banking at the ground level and business banking on the first floor. It’s a regional office for the western area, set over 710 sqm plus car parks, with 16m of frontage.

Banks, even with the threat of rate hikes, are typically considered sound investments. As a member of the Big 4, that confidence was only amplified. Additionally, the bank renewed their lease in 2019 for a term of seven years, with three further terms of five years. Fixed rental increases of 4% per annum are expected throughout the lease term, with reviews to take place at the commencement of the further terms.

As such, 22 Watton Street’s sale says a lot about the commercial property industry. But ultimately, the foundational message is this: the sector will endure high interest rates, so long as the property the buyer is receiving possesses the fundamental qualities which distinguish a high-quality asset from a lesser one. Good properties attract good results.