Ready Media Group recently took an extensive dive into the world of hybrid work, as prompted by JLL’s latest release in their Workforce Preferences Barometer series. Since then, JLL have released their Tenant Perspectives report for H122, and it sheds further light on the ways that the office is adapting to the rise of workforce flexibility and the demand for greater sustainability efforts. Here are some of the key takeaways from their extensive research article.

Businesses are back on the move

With 143,550 sqm in net absorption recorded in 2Q22 across national office markets, office sector activity has rebounded markedly since 2021, when JLL recorded only 21,399 sqm of net absorption in 4Q21. Part of this comes as businesses learn to adjust to the hybrid working model, which might not necessitate a business taking up as much core space as it previously had. As such, some organisations are downscaling as their spatial requirements reduce.

This isn’t the case for every business though. As Michael Greene, JLL’s Head of Tenant Representation in Australia, points out, “We’ve even seen some businesses take the same amount of space as they held previously, but with fit-outs that are more socially friendly."

“The right office can serve as a catalyst to improve relationships among leadership, enhance communication, drive innovation and create corporate culture. Access to a better range of facilities such as wellness and outdoor spaces, as well as amenities and location all play a pivotal role too.”

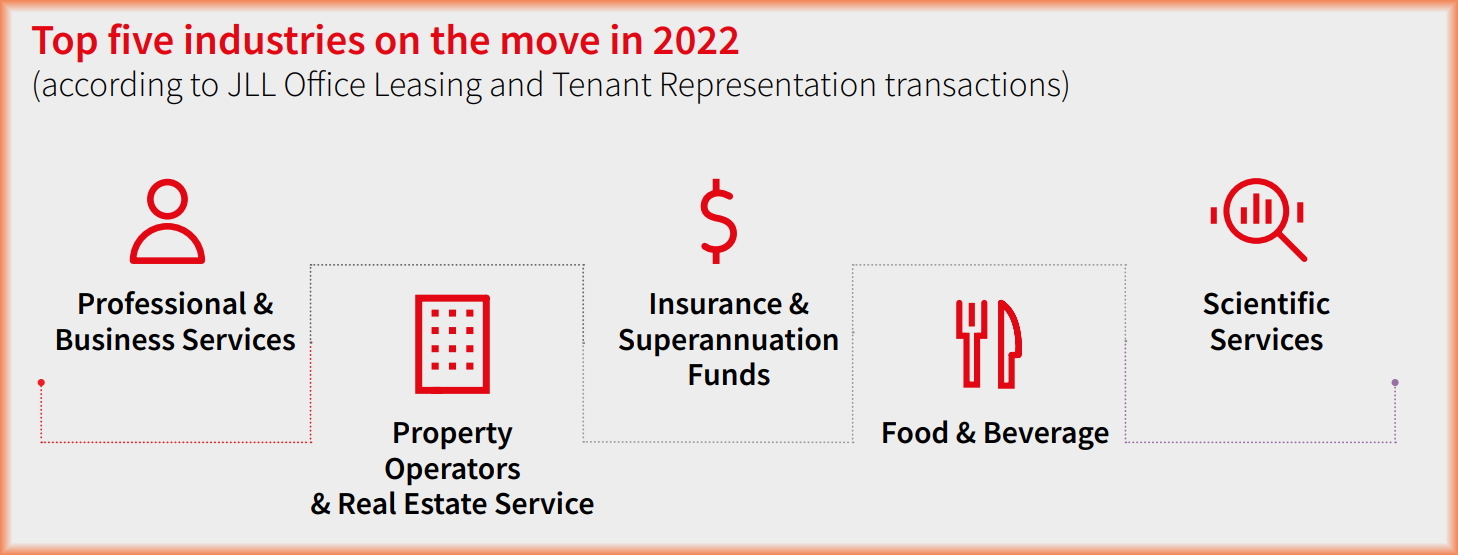

The “Professional and Business Services” industry has been one of the biggest contributors to the net absorption figures in 2022 thus far, with nearly each state experiencing significant office space demand from businesses operating in this sector. Since the start of 2021, enquiries from professional services have nearly doubled in Adelaide, and Brisbane has seen some of the city’s largest precommitments for speculative office space originating in the professional services industry.

Top five industries on the move in 2022 - Courtesy of JLL Australia

Other industries worth highlighting include Property Operators & Real Estate Service, Insurance & Superannuation Funds, Food & Beverage, and Scientific Services.

Sustainability is a commitment that both tenants and landlords are dedicating themselves to

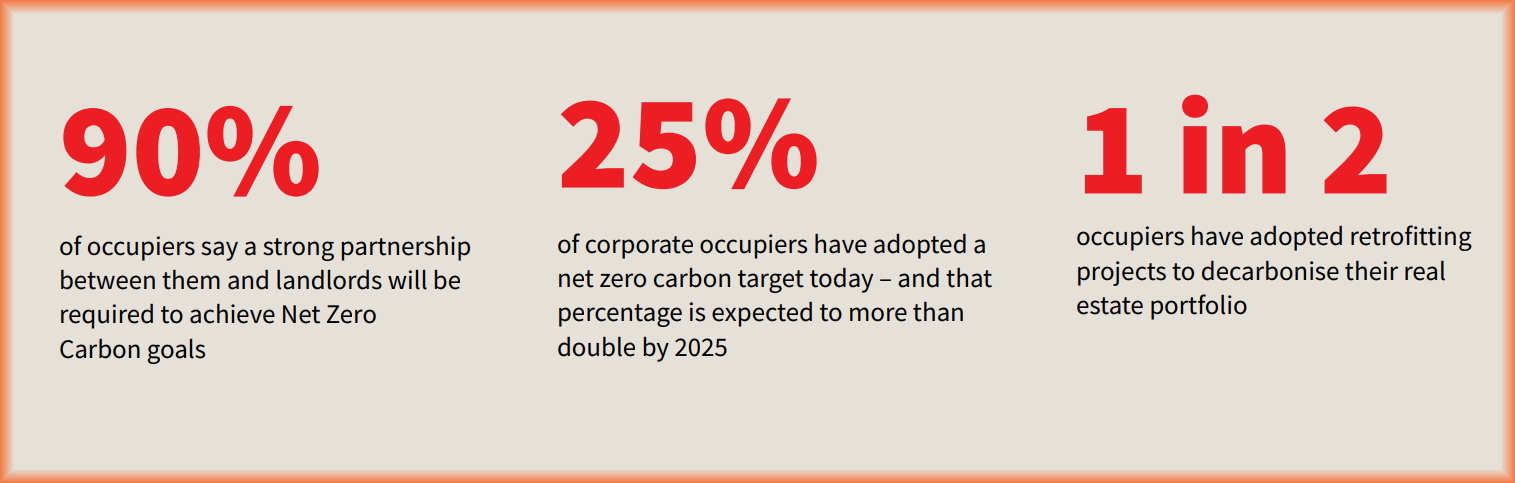

According to Mr. Greene, “25% of corporates have already adopted net zero carbon targets and that figure is expected to more than double by 2025.” The switch to sustainable practices by companies cannot be achieved in a vacuum; for organisations to achieve these lofty goals, they need to work in tandem with the landlords that govern their office space.

Key statistics for sustainability - Courtesy of JLL Australia

“When organisations commit to net zero carbon targets by a certain date, they’ll also need to ensure that the building they’re occupying, and the landlord are on the same path.”

In cases where a tenant’s lease extends over a decade, these discussions need to be conducted earlier rather than later. Anthony Clark, Senior Director of Tenant Representation – Sydney, explains how transparency will be key in navigating decarbonisation efforts in the coming years.

“Commitments to net zero may exclude tenants from being able to occupy certain office buildings in the future,” Mr. Clark emphasises. “It’s important to be aware and clear with your sustainability ambitions.”

Certain industries are being noted as those prioritising sustainability goals, with operators in the life science sector showing willingness “to pay more for office buildings with green credentials”, says Patrick McFarland, JLL’s Director of Tenant Representation in NSW. But ultimately, the expectation is that down the line, sustainability demand won't fluctuate based on industry, as businesses across the spectrum start to realise the value in taking up causes like net zero commitments.

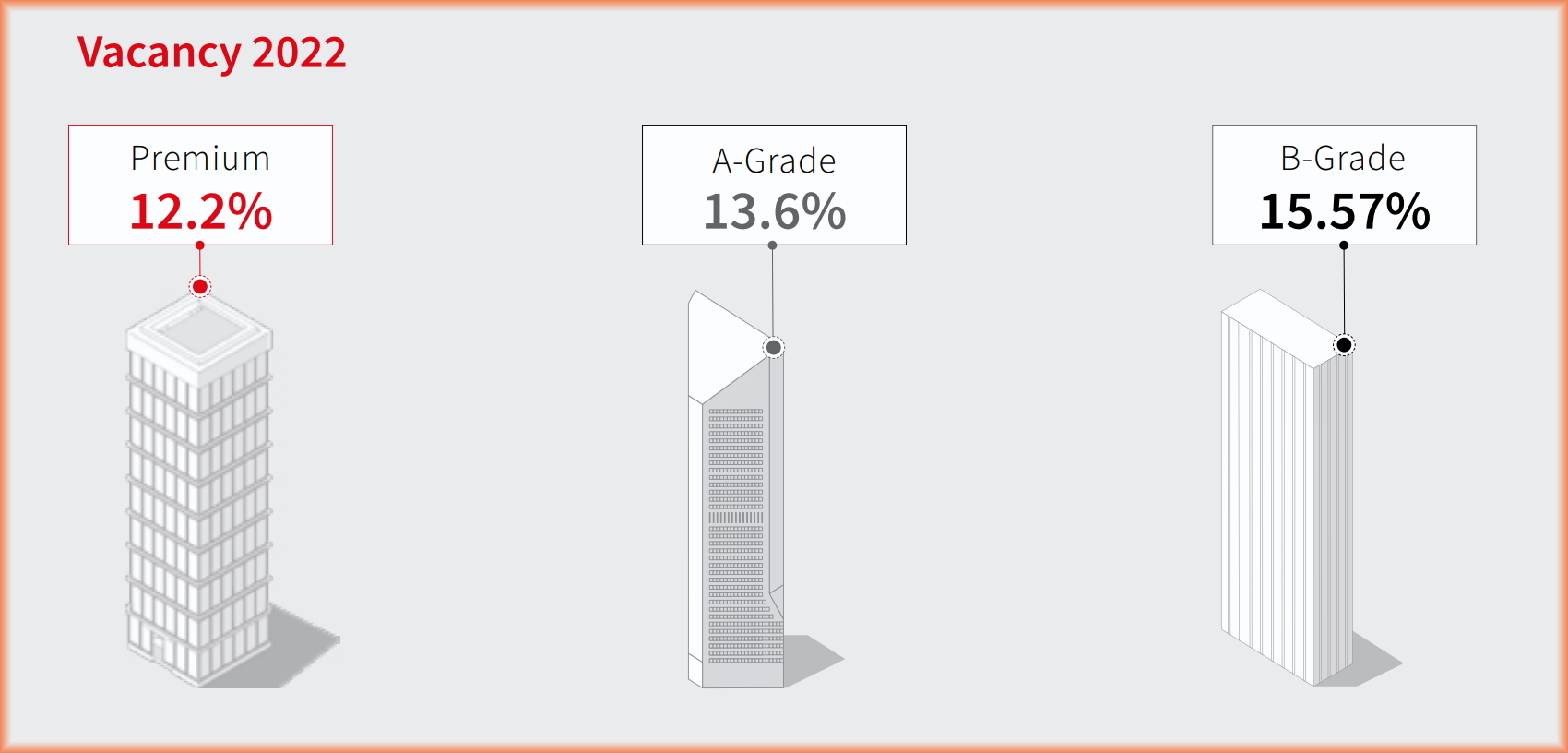

Premium Grade vacancy remains lowest

In terms of vacancy across the whole of Australia, premium grade buildings continue to possess lower vacancy rates relative to their lesser quality counterparts, as the flight-to-quality is elevating the demand for the best office spaces.

Vacancy rates for Premium, A-Grade, and B-Grade office stock - Courtesy of JLL Australia

In areas like the Melbourne Fringe market, organisations are actively gravitating towards higher quality office assets, with over 54% of new leases recorded being for Premium and A-Grade office stock. For the Sydney CBD, Premium building vacancy remains tight, with only 11.9% of Premium office space vacant, versus 13.6% of A-Grade and 14.0% of B-Grade.

This availability of space is most dichotomous in Perth, where Premium vacancy sits at 8.8%, compared to A-Grade at 19.9% and B-Grade at 28.1%. The headline vacancy rate for the city has remained around the 20% level as businesses respond to the accommodation of a more permanently agile workforce by consolidation of space.

Conversely, in the Melbourne CBD, Premium Grade (18.7%) has notably higher vacancy than its A-Grade (14.6%) and B-Grade (14.5%) counterparts, all the whilst total vacancy sits at 15%, which is close to the peak vacancy for the CBD over the past 20-years.

In JLL's report, the Director of Tenant Representation in Brisbane, Amanda Foggo, offers some advice that's intended specifically for Brisbane-based tenants, but feels pertinent for organisations all across Australia:

As the uncertainty of COVID-19 dissipates, the generous incentives are expected to remain, however we are seeing an upward trend in asking rent. This, in turn with higher interest rates and reduced investment activity will see landlords begin to push face rents once again in order to offset asset value reduction.

Rent hikes could very well be on the horizon seeing as the demand for high quality office space has increased substantially over the first half of 2022. Tenants should continue to evaluate their requirements and adjust accordingly, whilst the market remains incentive-rich.