The fifth volume in Fitzroys’ Walk the Strip series has been released, and it highlights the continued return-to-form from Melbourne’s most reputable shopping strips. Across 36 of the city’s most well-renown retail precincts, commercial tenancy figures are looking exceptional, and vacancy rates have (in most cases) dipped from their 2021 highs.

“Melbourne’s strip centres provide an environment in which people want to shop and find community,” explained Fitzroys’ Division Director of Agency, James Lockwood.

According to the report, the way many are trying to find community is via the food and beverage sector, which has experienced a significant uptick in prominence this past year. The average proportion of F&B tenancies across the surveyed shopping strips reached a record-high of 33.4%, with the report identifying that 89% of the shopping strips witnessed an increase in the proportion of F&B tenants over the past year.

James Lockwood - Fitzroys' Division Director, Agency

“A spike in eateries with a focus on takeaway and delivery was the first visible leasing response to COVID-19 in Melbourne’s shopping strips, as operators sought to move into smaller spaces with existing kitchen infrastructure."

Mr. Lockwood believes that the contraction of the specialty and service retail sectors relative to F&B is a follow-on effect from the pandemic, which forced non-essential businesses to close their doors whilst food retailers could continue to produce income via delivery services.

“A number of food and beverage operators saw their business as ‘COVID-proof’ through operating in lockdown, and as we’ve transitioned to a COVID-normal environment, they’ve actually seen an increase in turnover.”

This F&B growth has seen a simultaneous decline in the proportion of specialty tenancies, which have hit a long-term low of 30.9%. For reference, speciality retail accounted for 37.7% of leases in 2017.

To get a more complete idea of the sector and its trends, let’s explore some of the more notable individual shopping strips.

Centre Road, Bentleigh

Few retail hubs demonstrate the sudden growth in F&B better than Burleigh’s Centre Road, which has recently become one of the city’s best performing shopping strips. Its hospitality scene is expanding at a startlingly rate; F&B assets made up 37.6% of all Centre Road tenancies during this year’s survey, which is a marked increase from the 23.9% figure reported for 2021.

Thanks to the removal of the area’s rail crossing, foot traffic has increased and traffic flow is much improved, increasing accessibility for the strip. Some notable new shops adding to the mix include fish and chip outlet Hunky Dory, Artisanal Bakehouse, and Bentleigh Social.

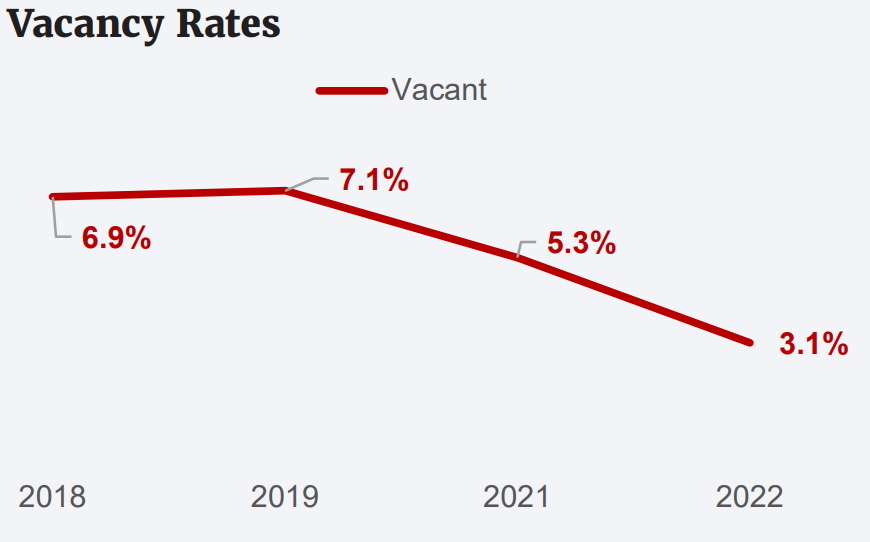

The vacancy rate in Centre Road experienced a dip in 2021, and that trend has only continued, as vacancy hit a low of 3.1%, indicating demand for space on the strip is as competitive as ever. With the local council initiating works for Bentleigh Eat Street, which plans to utilise what is currently a rotunda and plaza to the south of Centre Road and transform it into an extension of the strip’s commercial space, expect the vacancy rate to remain low in the years to come.

Clarendon Street, South Melbourne

One of the major trends evident throughout the report is that many of the city’s major shopping strips are seeing development work undertaken at a much higher rate than in years prior, and South Melbourne’s popular Clarendon Street articulates this point better than most. The development pipeline for the surrounding area has increased markedly, with major office construction occurring nearby on Clark Street, in addition to BTR projects by Macquarie-backed Local and US giant Greystar. These developments are predicted to contribute positively to foot traffic statistics, aiding retail on the strip.

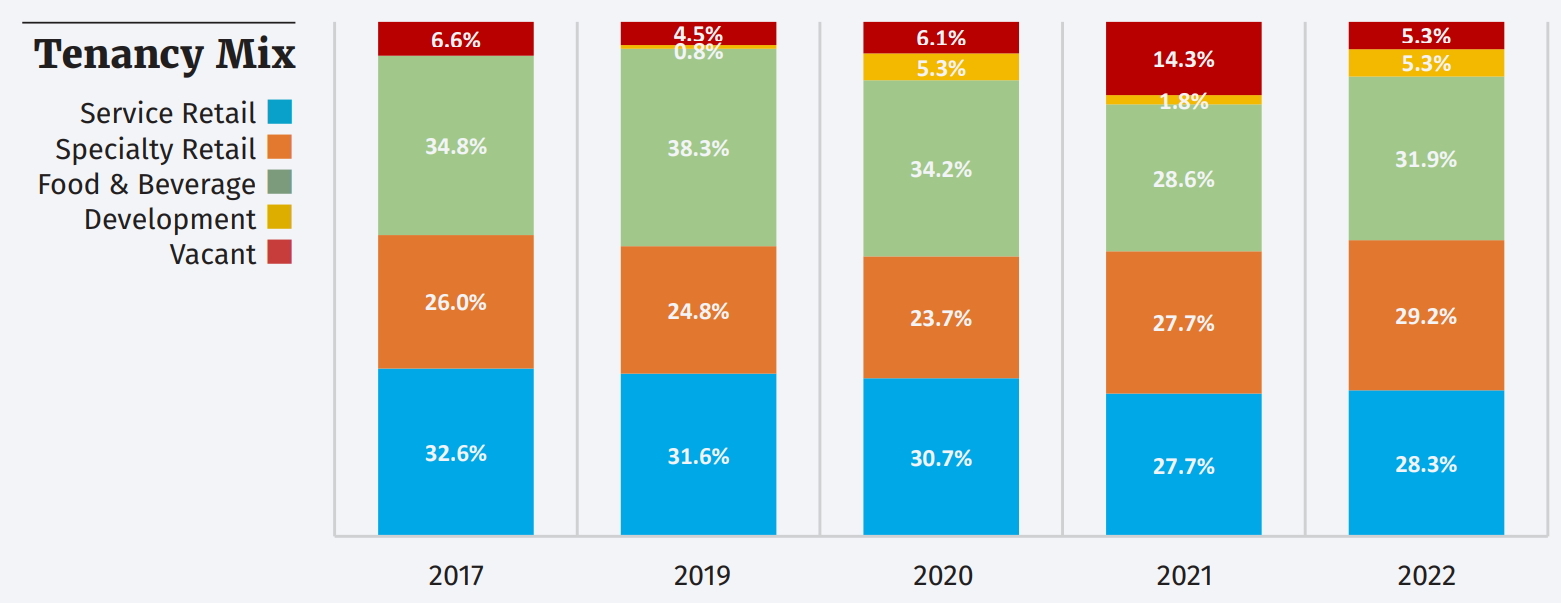

Tenancy Clarendon Street

Development proportion on Clarendon Street increased from 1.8% in 2021 to 5.3% for this survey, mirroring a similar shift between 2019 (0.8%) and 2020 (5.3%). Supplementing the impressive speculative supply is a massive increase in occupancy, as the 14.3% vacancy rate from last year was reduced down to 5.3%.

All of this comes as Clarendon Street boasts one of the major strip’s highest rental ranges – between $1,000 - $1,200 per sqm. But when the day trade is as strong as that which Clarendon Street experiences, tenants are more accepting of the higher grade in rent.

Hampton Street, Hampton

Yields don’t come lower than on Hampton Street, which saw a number of transactions which rendered sub-4% yields over the course of the year. 349 Hampton Street was sold by Fitzroys’ Chris Kombi, Mark Talbot and Tom Fisher for $2.45 million, generating an extremely sharp 2.82% yield. 462 Hampton Street, occupied by longstanding tenant Fazio’s, was able to secure a $1.77 million sale, for a yield of 3.2%.

462 Hampton Street, Hampton VIC 3188

Hampton Street was another shopping strip which benefitted significantly from a F&B uptake, as the proportion of F&B tenants in the area increased by 7.1% between 2021 and 2022. Amongst the new entrants onto the strip were burger specialists Grill’d, popular Woodfrog Bakery, and Si Senor Taqueria, all of which contributed to the vacancy rate plummeting to 4.7%.

“Melbourne’s local shopping strips have well and truly bounced back from the biggest crisis the city has faced in decades," according to Mr. Lockwood.

If anything is clear from this report, it’s that shopping strips all across Melbourne are on the up-and-up, and with developers increasing their positions in these commercial precincts, don’t expect the momentum to slow down anytime soon.